Stock Market: What it is and how it works?

The financial exchange (stock market) is a star grouping of trades where protections like stocks and bonds are traded. In the US, “the financial exchange” and “Money Road” can allude to the whole universe of protections exchanging — including stock trades where the portions of public organizations are recorded available to be purchased and showcases where different protections are exchanged.

The financial exchange assists organizations with fund-raising to support tasks by selling portions of stock, and it makes and supports abundance for individual financial backers.

Organizations fund-raise on the financial exchange by selling possession stakes to financial backers. These value stakes are known as portions of stock. By posting shares available to be purchased on the stock trades that make up the securities exchange, organizations gain admittance to the capital they need to work and extend their organizations without assuming obligation. In return for the honor of offering stock to the general population, organizations are expected to unveil data and give investors a say in how their organizations are run.

Financial backers benefit by trading their cash for shares on the securities exchange. As organizations set that cash to work developing and growing their organizations, financial backers receive the rewards as their portions of stock become more important after some time, prompting capital additions. Likewise, organizations deliver profits to their investors as their benefits develop

The exhibitions of individual stocks shift broadly over the long haul yet taken all in all the securities exchange has generally compensated financial backers with normal yearly returns of around 10%, making it one of the most dependable approaches to developing your cash.

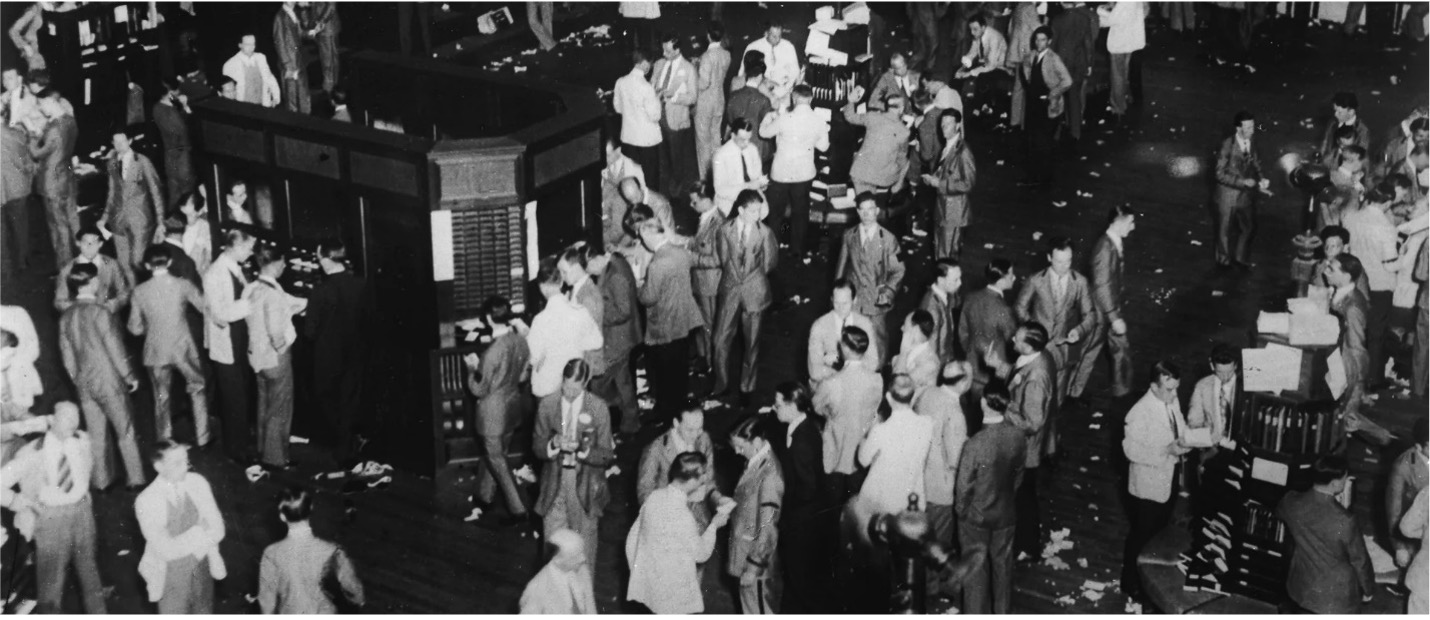

The Money Road Crash

The Money Road Crash of 1929, otherwise called the Incomparable Accident, was a significant American securities exchange crash that happened in the fall of 1929. It began in September and finished late in October, when offer costs on the New York Stock Trade fell.

It was the most obliterating financial exchange crash throughout the entire existence of the US, while thinking about the full degree and span of its delayed consequences. The Incomparable Accident is for the most part connected with October 24, 1929, called Dark Thursday, the day of the biggest auction of offers in U.S. history, and October 29, 1929, called Dark Tuesday, when financial backers exchanged exactly 16 million offers on the New York Stock Trade in a solitary day. The accident, which followed the London Stock Trade’s decline of September, flagged the start of the Economic crisis of the early 20s.

The Thundering Twenties thundered most intense and longest on the New York Stock Trade. Share costs rose to phenomenal levels. The Dow Jones Modern Normal expanded six-crease from 63 in August 1921 to 381 in September 1929. After costs crested, financial specialist Irving Fisher broadcasted, “stock costs have reached ‘what resembles a forever high level.'” 1

The legendary win finished in a destructive failure. On Dark Monday, October 28, 1929, the Dow declined almost 13%. On the next day, Dark Tuesday, the market dropped almost 12%. By mid-November, the Dow had lost close to half of its worth. The slide went on through the mid-year of 1932, when the Dow shut down at 41.22, its least worth of the 20th 100 years, 89 percent underneath its pinnacle. The Dow didn’t get back to its pre-crash levels until November 1954.

The Moscow Trade (MOEX) is the biggest trade in Russia, working exchanging markets values, securities, subordinates, the unfamiliar trade market, currency markets, and valuable metals. The Moscow Trade additionally works Russia’s focal protections store, the Public Settlement Vault (NSD), and the country’s biggest clearing specialist organization, the Public Clearing Community. The trade was framed in 2011 in a consolidation of the Moscow Interbank Money Trade and the Russian Exchanging Framework.

Exchanging at the trade was suspended on 24 February 2022, following Russia’s intrusion of Ukraine. Exchanging stayed suspended until 21 Walk, and was then just opened for state bonds. The trade was likewise focused on as a component of global assents against Russia. On August 15 2022, it was reported that the security market opened to cordial financial backers.

The Moscow Trade was laid out on 19 December 2011 by combining the two biggest Moscow-based trades, the Moscow Interbank Cash Trade (MICEX) and the Russian Exchanging Framework, consequently the name “Moscow Trade MICEX-RTS”. The two associations had been shaped during the 1990s and were driving Russian trades for quite a long time with their MICEX Record and the RTS File. The consolidation made a solitary element to help Russia’s arrangements to transform Moscow into a worldwide monetary focus.

The trade finished a first sale of stock on 15 February 2013, raising 15 billion ₽ (roughly US$500 million). The contribution, at the time the biggest at any point held only in Moscow, was beyond two times oversubscribed and drew interest from institutional financial backers worldwide. The trade’s portions were remembered for the MSCI Russia Record in November 2013. In July 2014 the National Bank of Russia, the biggest investor of the trade, finished the public offer of offers addressing almost 12% of the trade. A Russian government regulation requires[needs update] the National Bank to completely sell its stake in the trade by 1 January 2016. In October 2018, Moscow Trade sent off the exchanging of deliverable gold fates on its Subordinates Market. Gold are conveyed through valuable metals market spot segment.

In the interim, Asian Securities exchange is blasting presently. BEIJING — Asian financial exchanges expanded their misfortunes Tuesday in the midst of agony about more fragile worldwide monetary development as national banks raise loan fees to cool expansion.

Markets are sliding after the U.S. Central bank raised its key loaning rate last week and the European National Bank said more rate climbs are ahead. That energized financial backer feelings of trepidation national investors may make a downturn battle expansion that is at multi-decade highs.

Money Road declined Monday for a fifth day after the Fed said last week rates could need to remain raised longer than recently figure.

“The tone in business sectors mirrors an overcast viewpoint for the worldwide economy,” said Anderson Alves of ActivTrades in a report.

The Shanghai Composite Record SHCOMP, – 0.30% lost 0.6% after the World Bank cut its gauge of China’s financial development this year to 2.7% from its June viewpoint of 4.3%. The bank refered to rehashed closures of significant urban communities to battle Coronavirus flare-ups.

Asian business sectors are blended. The Hang Seng is higher by 0.16%, while the Nikkei 225 is driving the Shanghai Composite lower. They are down 0.76% and 0.06% separately.